After a significant slowdown of real estate investment and debt markets as a result of increasing financing rates in 2022, experts from the Real Estate Research Centre at Bayes Business School (formerly Cass) look ahead to what 2023 holds in store.

Real estate practitioners face the biggest challenge of their careers

For the first time in more than a decade, the European real estate market has reached a downward turning point in the cycle with many struggling to predict when a trough will eventually be reached.

Dr Nicole Lux, Senior Research Fellow at Bayes, said the downturn would be a sharp learning curve for plenty of industry practitioners.

“Many real estate professionals are now experiencing the first downward cycle they have known,” she said.

“They will have to learn quickly to navigate their investments through uncertain times.”

Asset classes are in danger of post-Covid value correction

Dr Lux fears false optimism in the face of recent and current economic adversity, given that shocks typically operate on a lapse for several years.

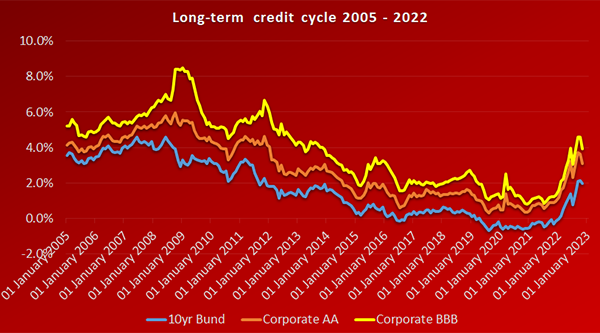

“Real estate market performance is strongly linked with economic cycles, but with a time delay to other asset classes,” Dr Lux continued.

“Most real estate debt has a maturity date of three to five years, which naturally holds up the effects of economic shocks and geo-political events – such as the ones we have witnessed with Covid-19 and the war in Ukraine.

“Asset classes, for example, grew throughout the pandemic in areas like logistics.”

Source: Bloomberg

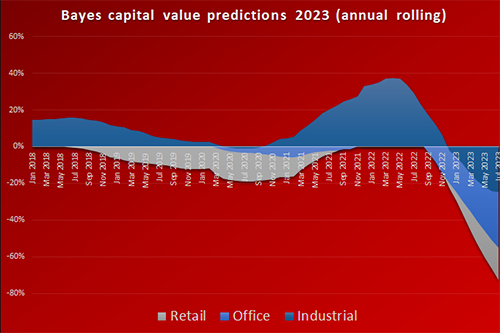

Dr Alexandros Skouralis, Research Assistant at Bayes, believes the impact will be felt differently across sectors.

“These assets are now at greater risk of seeing a downward value correction,” Dr Skouralis said.

“However, not all property types will be equally affected.

“The latest Bayes Commercial Real Estate Lending Report suggests that while increased interest rates are a concern for borrowers, the staggered maturity profile of loans means rates will only affect between 15 and 20 per cent of borrowers or lenders each year.

“On the other hand, property values might still be declining when the rest of the economy is growing again. While Real Estate Investment Trusts (REITs) have already been trading at large discounts throughout 2022, property valuations have been holding up longer – according to the Bayes Commercial Real Estate Monitor.”

Aftermath of REITs valuation correction

After the significant valuation correction of REITs in 2022, all eyes will be on their use and applications in the year ahead.

Alex Moss, Director of the Real Estate Research Centre, said the Centre’s research will focus heavily on four main areas.

"As a Centre, we are particularly interested in seeing how valuation correction continues into 2023,” Mr Moss said.

“Specifically, our research will concentrate on the implicit pricing of listed versus direct real estate, quantifying the impact of structural and cyclical changes across different sectors, the use and applications of REITs for multi-asset solutions funds, and valuation approaches for successful impact investing and sustainability strategies in the listed real estate market "

“Market corrections in real estate investment are expected to take place throughout the next 12 months.”

Three key areas to look for to create value in asset management

Dr Lux says that despite the current downward cycles there are also opportunities to create value, citing three key areas.

Decarbonisation

“In order for investments to be aligned with the Paris Agreement, buildings need to reduce their embodied carbon,” she said.

“These are emissions that are ‘locked into’ the structure of the buildings – such as from steel, windows or insulation produced to construct, maintain and refurbish a building – as well as operational carbon in the form of emissions from energy used for heating, running appliances and other end uses.

“The built environment accounts for approximately 40 per cent of global carbon emissions, yet all new buildings must operate at net zero carbon from 2030 and both new and existing buildings must operate at net zero by 2050.”

Environmental, Social and Governmental (ESG) consideration

Green real estate, flexibility and social impact investing are also becoming increasingly important to investors, according to Dr Lux.

“Occupiers have become more empowered and demanding, as they want great places to live and work,” she continued.

“To attract more buyers or tenants, property developers and owners must offer additional perks or provide well thought-out amenities. Opportunities include office buildings with smart technology, nearby amenities and access to electric vehicle (EV) charging stations, e-bikes or delivery points for e-commerce.

“Forward-looking real estate developers, investors and other stakeholders understand the importance of sustainability. This includes more than just optimising energy efficiency but also choosing eco-friendly materials.”

Digitisation and technology

Increasing transaction efficiency and reducing transaction costs through the use of digital solutions will also be a key game-changer in the year ahead and beyond.

“Prop-tech enables investors to manage their property investments remotely, facilitated by companies that offer setup and asset management using just a smartphone,” Dr Lux said.

“Our expectation at the Real Estate Research Centre is that these three areas will be the key value drivers to future-proof real estate investments from 2023 to 2030.

“It is far easier to achieve positive returns in a growing or stable market, and 2023 will be a challenge for investors, but there will be significant opportunities to achieve great returns for those who are savvy enough.

“We will be further contributing to environmental real estate research this year, with forthcoming publications thanks to our co-operation with Rightmove.co.uk and support from Ambiental Risk Analytics.”

All quotes can be attributed to Dr Nicole Lux, Senior Research Fellow, Alex Moss, Director, Real Estate Research Centre and Alex Skouralis, Research Assistant at Bayes Business School (formerly Cass).