Take a campus tour

Join one of our campus tours and visit our facilities, learn more about the University and get a taste of life at City.

Committed to academic excellence

-

Scholarships

The School of Policy & Global Affairs offer a range of scholarships across the school.

-

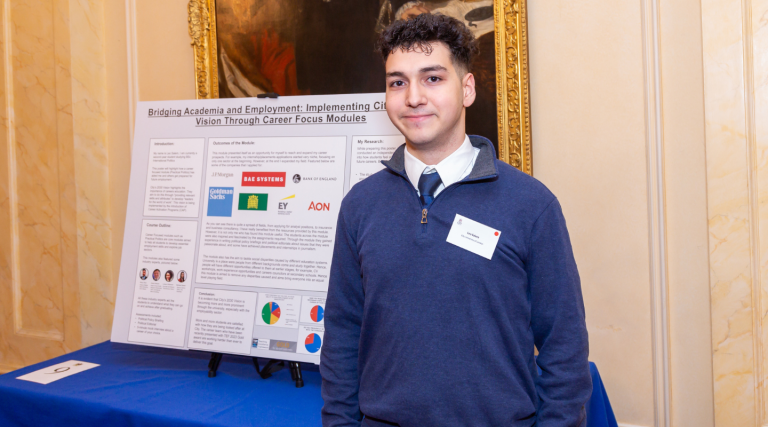

Research Case Studies

Learn more about how our researchers produce world leading and internationally acclaimed research, as measured by the Research Excellence Framework (REF).

-

Our people

City invests in the best staff from around the world, all experts in their fields. Read about our staff, and our current undergraduate and postgraduate, research and alumni students.